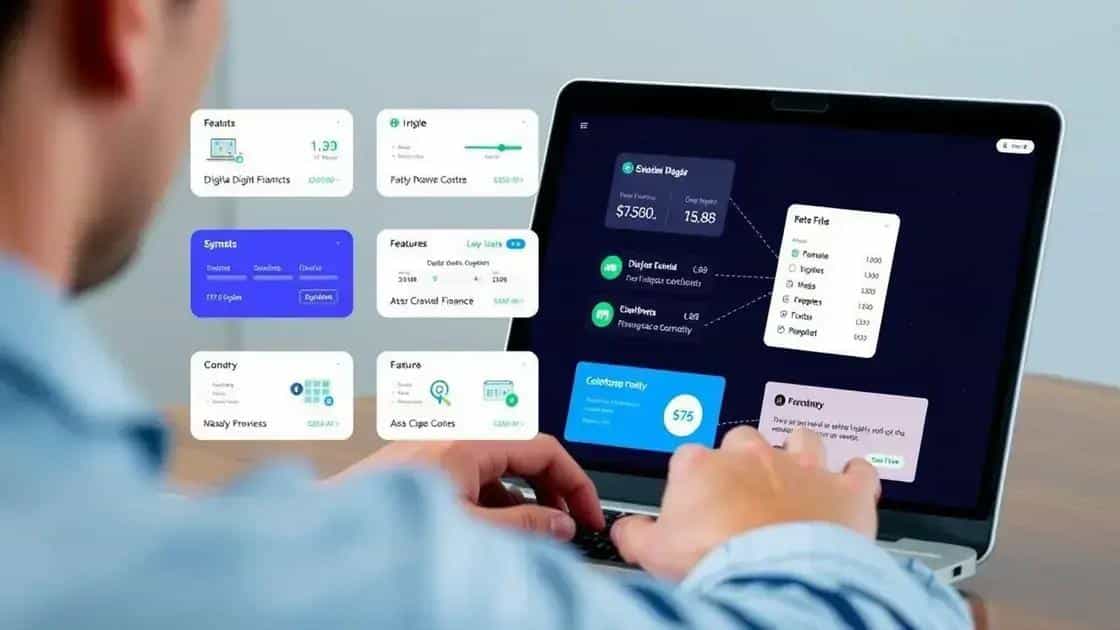

Mission digital finance tools: unlock financial success

Digital finance tools optimize financial management by streamlining invoicing, enhancing cash flow, and providing real-time insights, making them essential for businesses seeking efficiency and growth.

Mission digital finance tools can transform the way you manage your finances. Whether you’re a startup or an established business, these tools provide solutions that can optimize your operations. Curious about which tools fit your needs?

Understanding digital finance tools

Understanding digital finance tools is essential for anyone looking to manage their finances effectively. These tools can help streamline financial processes, making them more efficient and transparent. By leveraging technology, businesses can better track expenses, manage budgets, and forecast future financial scenarios.

Types of Digital Finance Tools

There are many types of digital finance tools available today. From budgeting apps to complex financial planning software, the options are vast. These tools not only help businesses manage their finances but also assist individuals in achieving their financial goals.

- Budgeting software to track income and expenses

- Financial forecasting tools for predicting future revenue

- Investment apps to manage and grow investment portfolios

- Accounting software for managing business accounts

Many of these tools come with user-friendly interfaces, making them suitable for both tech-savvy users and those new to digital finance. The best part is that numerous tools offer cloud-based services, allowing users to access their financial data anytime, anywhere.

Benefits of Using Digital Finance Tools

Implementing digital finance tools can yield significant benefits. For instance, they can enhance accuracy by reducing the chances of human error. Additionally, these tools provide real-time insights into financial health, allowing for quicker decision-making.

- Increased productivity through automation

- Improved accuracy in financial reporting

- Greater visibility into cash flow

- Time savings for finance teams

As businesses grow, the volume of financial data can become overwhelming. With the right digital finance tools, managing this data becomes easier and more structured. This enables organizations to focus on growth rather than being bogged down by administrative tasks.

Exploring the right digital finance tools for your needs can seem daunting, but it is a journey worth taking. With research and the right resources, you can find solutions tailored to your unique financial circumstances. By embracing these innovations, your financial management will evolve into a more straightforward, effective process who can help you achieve your long-term goals.

Benefits of using digital finance tools

Utilizing digital finance tools offers numerous advantages for individuals and businesses alike. These tools can simplify financial management, making it easier to track expenses and generate reports. As technology continues to evolve, embracing these tools becomes essential for staying competitive.

Efficiency in Financial Management

One primary benefit of digital finance tools is the increased efficiency they provide. They automate repetitive tasks, allowing users to focus on strategic decisions rather than data entry. This not only saves time but also reduces the risk of human error in financial records.

- Automated invoicing and billing

- Quick access to financial data

- Integration with banking systems

- Remote access to financial information

By having real-time access to your financial information, making informed decisions becomes much simpler. You can evaluate cash flow at any moment, allowing for better budgeting and planning. Furthermore, these tools enable seamless collaboration among teams, enhancing communication and transparency.

Improved Financial Insights

Another significant advantage is the enhanced financial insights that these tools provide. Users can generate detailed reports that offer perspectives on spending habits and investment opportunities. This level of analysis is often challenging to achieve without the assistance of technology.

- Customized financial dashboards

- Detailed expense tracking

- Analytics for strategic planning

- Forecasting future financial trends

When using digital finance tools, you are not only keeping track of your finances but also harnessing data to make smarter, evidence-based decisions. This proactive approach can lead to significant financial savings and growth over time.

As the landscape of finance continues to change, leveraging these digital tools is becoming more crucial. Ensure your organization stays proactive by adopting new technologies, which can ultimately lead to greater financial success.

How to choose the right digital finance tools

Choosing the right digital finance tools is essential for optimizing your financial management. With so many options available, it can be challenging to identify which tools best align with your needs. Here are some considerations to guide your selection process.

Identify Your Financial Needs

Before diving into the vast array of tools, take a moment to assess your specific financial needs. Are you primarily looking for budgeting tools, or do you need comprehensive accounting solutions? Understanding your requirements will help narrow down your options.

- Budgeting and expense tracking

- Invoicing and billing management

- Investment monitoring

- Cash flow analysis

Additionally, consider whether you need features such as mobile access or integration with other software systems. Knowing your priorities ensures that you choose tools that enhance your financial efficiency.

Evaluate Features and Usability

Once you have defined your needs, evaluate the features offered by different digital finance tools. Look for solutions that provide user-friendly interfaces, as ease of use can significantly affect how effectively you can manage your finances. A tool that is complicated may lead to frustration and errors.

- Intuitive dashboards for quick insights

- Customizable templates for reports

- Automated features for repetitive tasks

- Collaboration tools for team access

Take advantage of free trials or demos to assess these features firsthand. This hands-on experience can help you determine if a tool aligns with your workflow and preferences.

Consider Your Budget

Another critical factor is your budget. While some digital finance tools come with a higher price tag, others offer robust features at lower costs. Evaluate not just the initial investment, but also any ongoing fees associated with subscription models. Always ensure that the tool you choose provides good value for the cost.

Lastly, consider user reviews and testimonials. Peer experiences can provide insight into the effectiveness and reliability of a tool. They may point out potential drawbacks you hadn’t considered. By approaching your selection with a thorough understanding of your needs, evaluation of features, and budget considerations, you can choose the right digital finance tools for your situation.

Integrating digital finance tools into your business

Integrating digital finance tools into your business can transform your financial management processes. This shift not only enhances efficiency but also boosts accuracy in handling financial data. When successfully implemented, these tools provide real-time insights and streamline operations.

Assess Your Current Processes

Before integrating new tools, assess your current financial processes. Identify areas where your workflow can improve or where time is wasted. Understanding your existing systems will guide you in choosing the right tools that fit seamlessly into your business.

- Evaluate manual processes that can be automated

- Identify bottlenecks in data entry or reporting

- Consider areas that lack visibility or data

- Engage your team for insights on current challenges

After this assessment, you can determine which features are essential in new software solutions. The right digital finance tools should complement your existing systems, not complicate them.

Choose Tools that Integrate Well

When selecting digital finance tools, prioritize those that offer compatibility with your current software. Many solutions provide APIs or integrations that allow for seamless data exchange. This ensures that you maintain a single source of truth for your financial data, leading to better decision-making.

- Look for tools with plug-and-play features

- Check for compatibility with your accounting software

- Seek solutions that allow data sharing across platforms

- Test integrations to ensure smooth functionality

Choosing tools that work well together minimizes disruptions and enhances the overall financial workflow. Ensuring compatibility can save time and resources in the long run.

Training and Support

After selecting the right tools, it is crucial to provide adequate training for your team. Familiarity with the tools will promote better utilization and result in improved performance. Offering ongoing support during the transition period is equally important.

Providing a detailed onboarding experience helps your staff adapt smoothly to the new systems. Whether through online tutorials, workshops, or live sessions, the goal is to ensure everyone is comfortable with the new digital finance tools.

As your business evolves, continue to assess the effectiveness of the integrated tools. Regularly soliciting feedback from your team can lead to adjustments that optimize performance and enhance financial management.

Real-world success stories with digital finance tools

Real-world success stories highlight the impactful benefits of digital finance tools. Many businesses have embraced these technologies to optimize their financial operations and achieve significant results. These stories not only inspire but also demonstrate the practical applications of these tools in various scenarios.

Small Business Transformation

Consider a local bakery that struggled with tracking inventory and managing finances. After implementing a digital finance tool, the owner could easily monitor sales and expenses. Automation features also allowed for timely invoicing, leading to improved cash flow. As a result, the bakery increased its profits by 25% within the first year.

- Streamlined inventory management

- Improved cash flow through prompt invoicing

- Real-time financial insights for decision-making

This bakery’s journey emphasizes how digital finance tools can make a meaningful difference, especially for small businesses looking to grow.

Enhancing Efficiency for Large Enterprises

In another case, a large manufacturing company adopted a comprehensive financial management system. This tool allowed for seamless integration with their existing infrastructure. The company reported a 40% reduction in reporting time and significant savings on administrative costs. Employees were able to redirect their efforts towards more strategic tasks, significantly enhancing overall productivity.

- Faster reporting with real-time data

- Cost savings through streamlined processes

- Increased focus on strategic initiatives

The success of this manufacturing company illustrates that digital finance tools can cater to organizations of all sizes, driving efficiency and effectiveness across the board.

Case Study: E-commerce Growth

An e-commerce startup utilized a digital finance solution to manage its transactions and customer accounts. By integrating payment processing and accounting services, the business could track its financial performance in real-time. This approach led to increased customer satisfaction and a rise in sales by over 50% in just a few months.

This example showcases how integrating financial tools can help businesses respond faster to market demands while maintaining accurate financial oversight. As companies continue to navigate an increasingly digital landscape, the success stories of those utilizing digital finance tools offer valuable insights into best practices for achieving financial excellence.

In conclusion, integrating digital finance tools into your business can lead to remarkable improvements in efficiency and financial management. Numerous real-world success stories demonstrate how businesses, both small and large, have leveraged these tools for better cash flow, streamlined processes, and enhanced decision-making. By understanding your specific needs, choosing the right tools, and ensuring proper integration and training, you can unlock the full potential of your financial operations. Embrace the power of technology to foster growth and maintain a competitive edge in today’s digital landscape.

FAQ – Frequently Asked Questions about Digital Finance Tools

What are digital finance tools?

Digital finance tools are software applications that help individuals and businesses manage their financial operations, including budgeting, invoicing, and accounting.

How can digital finance tools improve cash flow?

These tools streamline invoicing and payment processes, ensuring that funds are collected more quickly and that visibility into cash flow is enhanced.

Are digital finance tools suitable for small businesses?

Yes, digital finance tools are designed to cater to businesses of all sizes, providing scalable solutions that can grow with the needs of small businesses.

What should I consider when integrating digital finance tools?

When integrating, consider your existing processes, the compatibility of new tools with current systems, and the training needs of your team to ensure smooth adoption.