Unlock $5,000 HRA Benefits: 2025 Insider Guide to Health Reimbursement Arrangements

Health Reimbursement Arrangements (HRAs) offer a powerful, tax-advantaged way for employees to get reimbursed for out-of-pocket medical expenses, with 2025 bringing new opportunities to maximize these valuable benefits.

Are you ready to discover how to unlock $5,000 in HRA benefits in 2025? Health Reimbursement Arrangements are a cornerstone of modern employee benefits, offering significant financial advantages for managing healthcare costs. This guide will provide insider knowledge and practical solutions to help you navigate and maximize these valuable benefits.

Understanding Health Reimbursement Arrangements (HRAs)

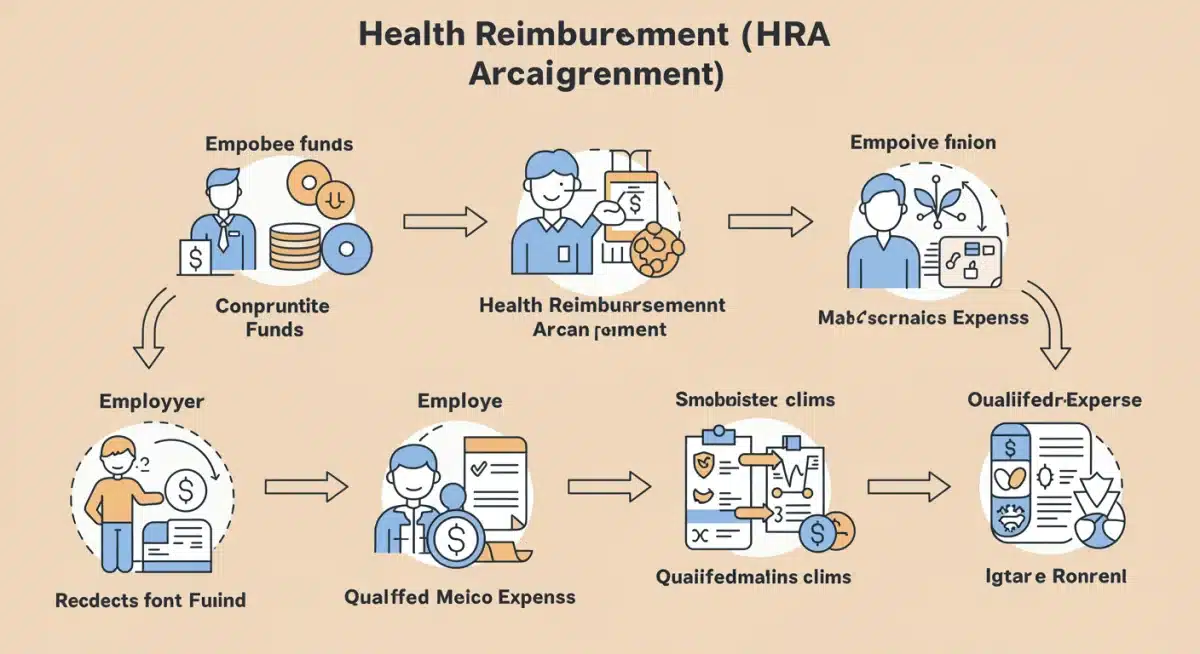

Health Reimbursement Arrangements, or HRAs, are employer-funded health benefit plans that reimburse employees for out-of-pocket medical expenses and, in some cases, health insurance premiums. Unlike Health Savings Accounts (HSAs), HRAs are entirely funded by the employer, and the funds are not portable if an employee leaves the company. However, they offer a unique tax advantage: reimbursements are generally tax-free to the employee, and employer contributions are tax-deductible.

The core purpose of an HRA is to help employees manage the rising costs of healthcare. By providing a dedicated fund for medical expenses, employers can offer a valuable benefit that supports employee well-being and financial security. For employees, this means less financial burden when facing unexpected medical bills or routine healthcare costs.

The fundamental mechanics of HRAs

- Employer-funded: Only employers can contribute to an HRA; employees cannot.

- Tax advantages: Reimbursements are typically tax-free for employees, and contributions are tax-deductible for employers.

- No cash payouts: Employees cannot withdraw funds as cash; funds are only for qualified medical expenses.

- Employer design flexibility: Employers dictate eligible expenses, maximum reimbursement amounts, and rollover policies.

The flexibility in HRA design is a key feature. Employers can tailor their HRA plans to meet the specific needs of their workforce and business objectives. This customization can range from defining which medical expenses are eligible for reimbursement to setting annual contribution limits. Understanding these design elements is crucial for employees to fully leverage their HRA benefits.

In essence, HRAs act as a bridge between high-deductible health plans and comprehensive coverage, allowing employees to access funds for healthcare costs without the upfront financial strain. This makes them a critical component of a robust benefits package, especially as healthcare costs continue to climb year after year.

Navigating the 2025 HRA Landscape: Key Changes and Opportunities

As we approach 2025, it’s essential to be aware of any potential changes or updates to HRA regulations and offerings. While major legislative overhauls are less frequent, subtle shifts in IRS guidance, market trends, and employer strategies can significantly impact how HRAs function and the benefits they provide. Staying informed is the first step to maximizing your HRA potential.

One area to watch closely is the potential for increased employer adoption of various HRA types. As businesses seek innovative ways to attract and retain talent while managing healthcare costs, HRAs offer a versatile solution. This could lead to more competitive HRA offerings, potentially including higher contribution limits or broader eligible expense categories.

Anticipated trends and regulatory updates for 2025

- Increased adoption of ICHRA: Individual Coverage HRAs (ICHRAs) are gaining popularity, allowing employers to offer tax-free funds for employees to purchase individual health insurance.

- Expanded QSEHRA limits: Qualified Small Employer HRAs (QSEHRAs) may see adjustments to their maximum reimbursement limits, affecting small businesses.

- Focus on preventive care: Expect a continued emphasis on reimbursing preventive care services to promote employee wellness.

The landscape of healthcare financing is constantly evolving, and HRAs are no exception. Employers are increasingly leveraging these arrangements to provide more personalized and flexible health benefits. This shift benefits employees by giving them more control over their healthcare spending and access to a wider range of services that align with their individual needs.

Furthermore, technological advancements in benefits administration are making HRAs easier to manage for both employers and employees. Digital platforms and mobile apps are simplifying the claims process, tracking expenses, and providing real-time access to HRA balances. This improved accessibility enhances the overall value and user experience of HRA benefits.

Maximizing Your $5,000 HRA Benefits: A Strategic Approach

To truly unlock $5,000 in HRA benefits, a proactive and strategic approach is necessary. It’s not enough to simply have an HRA; understanding how to optimize its use can lead to substantial savings and better health outcomes. This involves careful planning, detailed record-keeping, and a thorough understanding of your specific plan’s rules.

The first step is to familiarize yourself with your employer’s HRA plan document. This document outlines everything from eligible expenses to claim submission procedures and rollover policies. Many employees overlook this crucial resource, missing out on opportunities to utilize their benefits fully.

Key strategies for optimal HRA utilization

- Understand eligible expenses: Not all medical expenses are covered. Review your plan document carefully to know what qualifies.

- Track your spending: Keep detailed records of all medical expenses, receipts, and Explanation of Benefits (EOB) statements.

- Plan for big expenses: If you anticipate significant medical costs, factor your HRA into your financial planning.

- Leverage rollover options: If your plan allows, unused funds may roll over to the next year, increasing your long-term savings potential.

Consider scheduling an annual review of your HRA benefits with your HR department or benefits administrator. This can help clarify any ambiguities and ensure you are maximizing all available funds. Asking questions about common reimbursement denials and how to avoid them can also be highly beneficial.

Another often-underestimated strategy is integrating your HRA with other health savings tools, such as an HSA or Flexible Spending Account (FSA), if your plan design allows. While HRAs are typically employer-funded, understanding how they interact with other accounts can create a comprehensive healthcare financing strategy. This holistic view ensures no benefit goes unused and that you are always making the most cost-effective decisions for your health.

Qualified Expenses: What Your HRA Can Cover

The range of expenses an HRA can cover is broad, but it’s important to note that employers have the discretion to limit what is eligible under their specific plan. Generally, qualified medical expenses are defined by IRS Publication 502, which includes a vast array of services and products necessary for medical care. Knowing these can help you better plan your healthcare spending.

Beyond doctor’s visits and prescription medications, HRAs can often cover less obvious but equally important health-related costs. This expanded coverage can provide significant financial relief, making healthcare more accessible and affordable for employees and their families.

Commonly covered HRA expenses

- Medical services: Doctor visits, specialist consultations, hospital stays, surgeries.

- Prescription drugs: Medications prescribed by a doctor.

- Dental care: Cleanings, fillings, orthodontic treatments.

- Vision care: Eye exams, glasses, contact lenses, corrective surgery.

- Medical equipment: Crutches, wheelchairs, blood sugar monitors.

- Individual health insurance premiums: Often covered by ICHRA and QSEHRA plans.

It’s crucial to distinguish between what the IRS considers a qualified medical expense and what your employer’s HRA plan specifically allows. Always refer to your plan’s Summary Plan Description (SPD) or consult with your HR department. This ensures that any expense you submit for reimbursement will be approved, preventing delays or denials.

Some HRAs may also cover alternative treatments, counseling services, or even certain wellness programs, depending on the employer’s design. This flexibility allows employers to create benefit packages that truly cater to the diverse health needs of their workforce. By understanding these nuances, employees can optimize their HRA usage for a broader spectrum of health and wellness investments.

The Different Types of HRAs: Finding Your Fit

Not all HRAs are created equal. The world of Health Reimbursement Arrangements has diversified over the years, offering various models designed to meet different employer and employee needs. Understanding the distinctions between these types is crucial to comprehending the full scope of your potential benefits.

The evolution of HRAs reflects a broader trend in healthcare benefits towards greater flexibility and personalization. Employers are moving away from one-size-fits-all solutions, opting instead for arrangements that empower employees to make choices that best suit their individual health and financial situations.

Exploring common HRA models

- Integrated HRA: Designed to supplement a traditional group health plan, covering deductibles, co-pays, and other out-of-pocket costs.

- Individual Coverage HRA (ICHRA): Allows employers of any size to offer tax-free funds for employees to purchase individual health insurance on the open market or through an exchange.

- Qualified Small Employer HRA (QSEHRA): Specifically for small employers (fewer than 50 full-time employees) who do not offer a group health plan. It reimburses employees for health insurance premiums and qualified medical expenses.

- Excepted Benefit HRA (EBHRA): Can be offered alongside a traditional group health plan to reimburse employees for excepted benefits, such as dental, vision, or short-term, limited-duration insurance.

The choice of HRA type often depends on the employer’s size, budget, and overall benefits strategy. For employees, knowing which type of HRA they have is paramount, as each comes with its own set of rules, eligible expenses, and contribution limits. For example, an ICHRA offers significant freedom in choosing health insurance, while an Integrated HRA focuses on reducing out-of-pocket costs within an existing group plan.

This variety ensures that both large corporations and small businesses can leverage HRAs effectively. As an employee, being informed about your specific HRA type empowers you to ask the right questions and make the most of the benefits provided. It transforms a complex financial tool into a clear path toward significant healthcare savings and flexibility.

Common Pitfalls and How to Avoid Them with Your HRA

While HRAs offer fantastic benefits, navigating them isn’t always straightforward. There are common pitfalls that employees often encounter, leading to missed opportunities or reimbursement denials. Being aware of these challenges and knowing how to circumvent them is key to successfully managing your HRA and truly unlocking its full potential.

Many of these issues stem from a lack of understanding of the specific plan rules or insufficient documentation. Proactive engagement with your HRA is the best defense against these common problems, ensuring a smooth and efficient reimbursement process.

Avoiding HRA utilization mistakes

- Not understanding your plan: Always read your Summary Plan Description (SPD) carefully.

- Poor record-keeping: Keep all receipts, EOBs, and medical invoices organized and accessible.

- Missing submission deadlines: Be aware of the deadlines for submitting claims for reimbursement.

- Submitting ineligible expenses: Double-check if an expense qualifies under your specific HRA plan before submitting.

- Ignoring rollover rules: If your plan has a ‘use it or lose it’ clause, plan your spending accordingly.

One significant pitfall is assuming all medical expenses are universally covered. Employers have considerable leeway in defining what their HRA will reimburse. A medication or service covered by one company’s HRA might not be covered by another’s. Always verify eligibility specific to your plan before incurring an expense with the expectation of reimbursement.

Another common mistake is delaying claim submissions. While some plans allow for a grace period, timely submission prevents issues with lost documentation or forgotten expenses. Setting reminders and submitting claims shortly after incurring the expense can save you a lot of hassle and ensure you receive your reimbursements promptly. By taking these preventative measures, you can ensure your HRA works effectively for you.

| Key Point | Brief Description |

|---|---|

| HRA Fundamentals | Employer-funded plans reimbursing tax-free medical expenses, offering employer flexibility in design. |

| 2025 Outlook | Anticipate increased ICHRA/QSEHRA adoption and focus on preventive care, enhanced by tech. |

| Maximizing Benefits | Understand plan details, track expenses diligently, plan for costs, and leverage rollover options. |

| Avoiding Pitfalls | Prevent issues by knowing eligible expenses, submitting claims timely, and maintaining good records. |

Frequently Asked Questions About HRAs

The primary difference is funding and ownership. HRAs are employer-funded and owned by the employer, meaning funds are typically lost if you leave the company. HSAs are owned by the employee, can be funded by both employer and employee, and are portable, rolling over year to year even after job changes. HRAs generally don’t require an associated high-deductible health plan, unlike HSAs.

Yes, depending on the type of HRA. Individual Coverage HRAs (ICHRAs) and Qualified Small Employer HRAs (QSEHRAs) are specifically designed to reimburse employees for individual health insurance premiums. However, Integrated HRAs, which are typically paired with a group health plan, generally cannot be used for premiums for that same group plan, but may cover other out-of-pocket costs.

No, generally HRA reimbursements for qualified medical expenses are not considered taxable income to the employee. This is one of the significant advantages of an HRA, as it allows employees to pay for healthcare costs with pre-tax dollars, effectively reducing their overall tax burden. This tax-free status makes HRAs a very attractive benefit.

The rollover policy for unused HRA funds varies depending on the employer’s specific plan design. Some HRAs allow a portion or all of the unused funds to roll over to the next year, increasing your available balance. Other plans may have a ‘use it or lose it’ provision, where unused funds expire at the end of the plan year. Always check your plan document for details.

Yes, employers typically have the right to modify or terminate HRA plans. However, they are usually required to provide advance notice of any significant changes to employees. These changes can include adjustments to eligible expenses, contribution limits, or administrative procedures. It’s important to stay informed about communications from your employer regarding your benefits.

Conclusion

The opportunity to unlock $5,000 in HRA benefits in 2025 represents a significant advantage for employees seeking to manage their healthcare costs effectively. By understanding the fundamentals, staying informed about evolving regulations, strategically utilizing funds, identifying qualified expenses, and avoiding common pitfalls, individuals can maximize the financial relief and flexibility that HRAs offer. These employer-funded arrangements are more than just a benefit; they are a powerful tool for achieving greater financial security in an increasingly complex healthcare landscape. Proactive engagement with your HRA can lead to substantial savings and a more confident approach to your health and wellness investments.